The world’s cows are a major source of methane, one of the most powerful greenhouse gases. Now a German start-up backed by Google, Stripe and other blue-chip buyers is betting that shipping-container-sized power plants on cattle farms can turn that liability into clean power and permanent carbon removal – and, perhaps, a new rural income stream.

Table of Contents

ToggleA very different shed on the farm

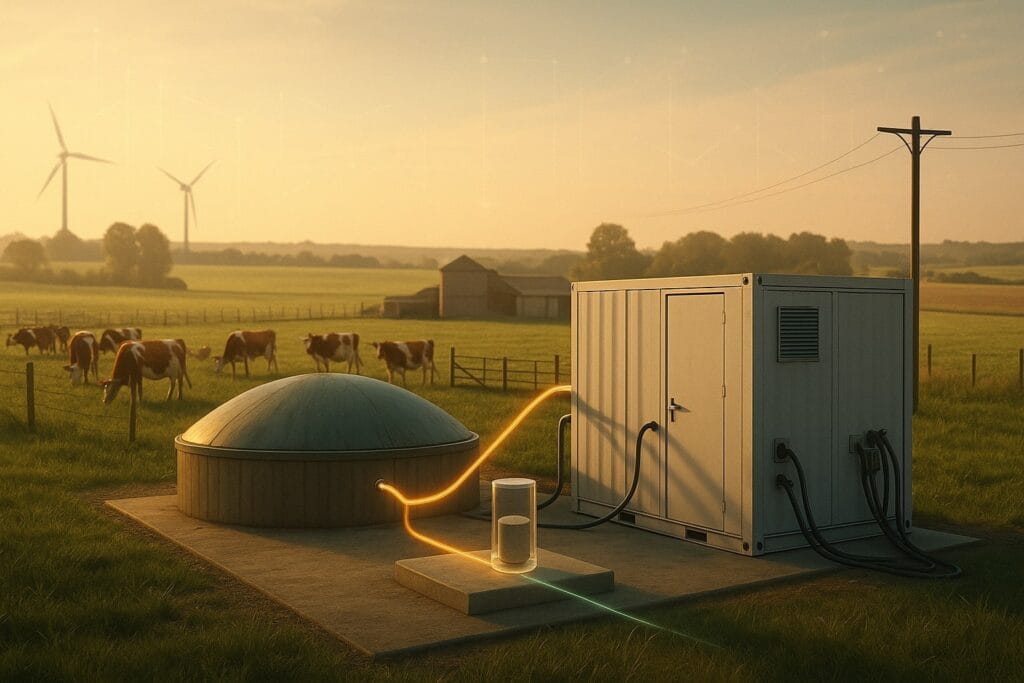

From a distance, a modern dairy operation in southern Germany looks familiar: cows, silos, a steel digester tank, maybe a small turbine. Tucked beside the barns, though, sits something new – a grey box, roughly the size of a shipping container, connected by pipes and cables to the farm’s biogas plant.

Inside that box, developed by Munich-area start-up Reverion, biogas from manure and crop residues is pushed through high-temperature solid oxide fuel cells. The cells generate electricity, but instead of venting exhaust gas to the air, the system produces a pure stream of carbon dioxide that can be compressed and shipped for permanent storage underground.

The idea is disarmingly simple: use the farm’s own waste to generate power at very high efficiency, capture all the carbon in the process – from methane and from CO₂ – and sell both the electricity and the resulting carbon removal credits.

Last week, the concept received a powerful vote of confidence. Frontier, the carbon-removal buyers’ club founded by Stripe, Alphabet, Shopify, Meta and McKinsey, agreed to pay Reverion $41m to remove 96,000 tonnes of CO₂ between 2027 and 2030.

For Frontier’s backers – which now include Google, H&M Group and a long list of consumer brands – this is not just a climate gesture. It is a bet that turning cattle farms into miniature carbon-negative power plants could one day remove hundreds of millions of tonnes of CO₂ a year.

Why cows are in the climate spotlight

Livestock have quietly become one of the central battlegrounds in climate politics. The Food and Agriculture Organization estimates that global livestock supply chains account for about 7.1 gigatonnes of CO₂-equivalent emissions a year – roughly 14.5% of all human-caused greenhouse gases. Cattle, for beef and milk, are responsible for around two-thirds of that total.

Much of the damage is due to methane. As cows digest their feed, microbes in the rumen produce CH₄, which animals release through burps. Manure stored in pits and lagoons generates more methane as it decomposes. UNEP estimates that livestock emissions from “manure and gastro-enteric releases” make up roughly 32% of human-caused methane emissions.

Methane does not linger as long as carbon dioxide – it stays in the atmosphere for about a decade – but in the short term it is far more potent. Over a 20-year period, methane causes about 80 times more warming per tonne than CO₂. That makes cutting methane one of the quickest ways to slow near-term temperature rise, a point stressed by scientists and negotiators at recent UN climate talks.

At the same time, demand for animal protein is still rising, particularly in emerging markets. For governments, the political cost of telling consumers to eat less beef often looks higher than the cost of subsidising technologies that promise to clean up the supply chain.

Hence the appeal of a solution that starts not with people’s diets, but with the slurry pit behind the barn.

How biogas works today – and where it falls short

The notion of using farm waste to produce energy is not new. Across Europe, China, India and Brazil, farmers have been feeding manure, crop residues and food scraps into anaerobic digesters for decades. The result is biogas – typically around 60% methane and 40% CO₂ – which can be burned in an engine to generate electricity and heat, or upgraded into biomethane and injected into gas grids.

Biogas is usually framed as “carbon-neutral”: the CO₂ released when it is burned was originally drawn down by plants, not dug up from underground. In practice, the climate story is murkier.

First, biogas plants rarely capture all their methane. Leaks can occur at digesters, in piping and during upgrading to biomethane. Because methane is such a powerful greenhouse gas, even modest leakage rates can wipe out much of the climate benefit.

Second, most conventional biogas systems vent the CO₂ portion straight to the air. That avoids additional fossil emissions, but it does nothing to reduce the stock of greenhouse gases already in the atmosphere.

Finally, biogas engines are not especially efficient. Combined heat-and-power units typically convert 35–40% of the fuel’s energy into electricity, with the rest lost as heat that is not always easy to use.

For years, these compromises were tolerated because biogas was seen primarily as a waste-management and rural-energy tool. As the focus shifts towards deep decarbonisation and explicit methane reduction, those trade-offs are being reassessed.

Inside Reverion’s “reversible” power plants

Reverion’s pitch is to turn this familiar infrastructure into something more ambitious.

Instead of sending raw biogas to an engine, the company bolts its system onto existing digesters and feeds the gas into solid oxide fuel cells. These ceramic devices operate at high temperatures, allowing them to convert chemical energy into electricity with unusually high efficiency – about 74% in Reverion’s case, according to Frontier, with a long-term goal of up to 80%.

Because the fuel cell does not mix the gas with air in the same way as a combustion engine, the exhaust stream is a nearly pure CO₂, rather than a dilute mixture. That makes it relatively straightforward to compress, liquefy and ship the gas for permanent storage in geological formations or other long-duration sinks.

In climate jargon, this is bioenergy with carbon capture and storage, or BECCS – but at farm scale, rather than at a centralised power plant.

Reverion’s units also run in reverse. When grid electricity is abundant and cheap, farmers can use the same stack as an electrolyser, turning water and biogas into hydrogen or synthetic methane, which can be stored or sold.

Frontier argues that this “reversible” architecture has several advantages:

- It doubles the amount of carbon removed from a given volume of biogas by capturing carbon from both methane and CO₂, rather than from the CO₂ portion alone.

- It offers some of the highest fuel-to-power efficiency of any thermal power plant, squeezing more electricity out of each tonne of manure.

- It minimises methane leakage by using the gas on site instead of upgrading and transporting it through pipelines.

The result, on paper, is a miniature power station that can be carbon-negative over its life cycle: it produces more climate benefit by removing CO₂ and displacing fossil electricity than it causes through its own construction and operation.

Frontier’s $41m experiment

For all the clever engineering, projects like Reverion’s do not scale without customers willing to pay for carbon removal that remains, for now, extremely expensive.

That is where Frontier comes in. Set up in 2022, the coalition has pledged to buy at least $1bn of permanent carbon removal between 2022 and 2030, using a mix of prepurchase contracts with early-stage suppliers and larger offtake agreements with technologies that are closer to market.

Under the new deal, Frontier buyers – including Google, Stripe, Shopify, H&M Group and others – will pay $41m for 96,000 tonnes of carbon removal delivered by Reverion between 2027 and 2030. That implies an average price in the mid-hundreds of dollars per tonne, broadly in line with other permanent removal contracts the coalition has struck with direct air capture, enhanced weathering and BECCS projects.

The offtake is modest in global terms. If delivered in full, 96,000 tonnes over four years is a rounding error next to the 7.1 gigatonnes of CO₂-equivalent emitted annually by livestock supply chains.

But the companies involved are not aiming to offset their entire agricultural footprint. Their goal is to help bring down the cost of a technology that could, if others follow, clean up a long-neglected corner of the energy system.

Frontier’s own analysis, drawing on International Energy Agency projections, suggests that scaling similar “biomass carbon removal and storage” approaches across the world’s biogas sites could in theory remove more than 2 gigatonnes of CO₂ a year by 2040.

That figure is aspirational. It assumes a large share of the global potential for biogas from manure, crop residues and organic waste is developed – and that a meaningful fraction of those plants adopt carbon-capture technologies rather than simply burning their gas.

What this looks like on the farm

For individual farmers, the case for installing a container full of fuel cells and compressors is less about abstract gigatonnes and more about cashflow and risk.

At first glance, the model offers three revenue streams:

- Electricity. Instead of selling raw biogas or running an engine, the farmer can generate electricity on site and feed it into the grid. With efficiencies approaching 74%, more of the energy content in the gas becomes power, improving returns.

- Hydrogen or synthetic gas. When wholesale power prices fall – for example on sunny, windy days – the plant can shift into electrolysis mode, producing hydrogen or methane that can be stored, used on farm or injected into local networks.

- Carbon removal credits. Once storage sites are in place, the captured CO₂ stream can be delivered to permanent storage operators. The resulting removal credits are sold to buyers like Frontier at prices far higher than conventional carbon offsets.

Reverion and Frontier also emphasise non-financial benefits. On-farm power generation can improve resilience during grid outages. Reducing methane leaks and better managing manure can ease local odour and air-quality problems.

Still, the economics are not trivial. Solid oxide fuel cells are capital-intensive and operate at high temperatures, which demands robust materials and maintenance regimes. Compressing and transporting CO₂ requires additional equipment and, in most regions, new infrastructure for pipelines, shipping or injection wells.

Without premium buyers such as Frontier, it is hard to imagine early projects offering a compelling payback to farmers. Even with those buyers, uptake will depend on how much risk developers are willing to shoulder and how much public support governments provide, for instance through grants or contracts-for-difference for carbon removal.

Gigaton potential, local realities

The numbers quoted by Frontier – over 120,000 biogas sites worldwide and a theoretical carbon-removal potential exceeding 2 gigatonnes a year by 2040 – are eye-catching.

A closer look reveals several constraints.

Feedstock limits. Not all manure is equal. Some of it is too dilute or too dispersed to justify collection and digestion. Competing uses – such as direct application to fields or composting – may be more attractive in certain regions.

Infrastructure gaps. Many existing biogas plants are in places with weak grid connections and no obvious route to CO₂ storage sites. Building pipelines or CO₂ hubs to serve distributed farms will be slow and politically sensitive.

Policy risk. In Europe, biogas faces the same regulatory flux as other renewables: changing feed-in tariffs, debates over land use, and competition from biomethane mandates. In emerging markets, basic grid reliability and access to credit are often bigger obstacles than technology.

Social licence. Turning cattle farms into energy and carbon hubs may play well with some communities, but poorly with others, particularly where large industrial barns are already controversial.

Even the climate arithmetic requires caution. Biogas-with-capture projects that rely heavily on energy crops risk encouraging more intensive agriculture or land-use change, undermining their net benefit. Frontier’s modelling leans on waste streams – manure, crop residues, municipal waste – rather than dedicated plantations, but real-world boundaries are hard to police.

A broader climate-tech stack for the countryside

Seen in isolation, Reverion’s boxes are a technical curiosity. Seen alongside other developments in climate-smart agriculture, they look more like one piece of a larger puzzle.

In India, for example, agritech platforms such as AgroStar now provide more than 10 million smallholders with agronomy advice, climate-resilient seeds and market access through smartphone apps and local centres. The company recently raised $30m from climate-focused investor Just Climate and others to expand what it calls “climate-smart product innovation” and AI-driven advisory tools.

That is a very different business from container-scale fuel cells in Germany. Yet both reflect the same underlying shift: climate tech is moving beyond urban solar roofs and electric cars into the messy, distributed reality of farms and rural infrastructure.

If the transition is to be politically durable, that matters. Rural communities have often experienced climate policy as a set of constraints – on fertiliser, on land use, on livestock numbers – rather than as a source of new income or investment. Technologies that turn waste into revenue, or provide better information and resilience against volatile weather, can help rebalance that story.

Risks and hard questions

None of this makes the “manure-to-megawatts” vision risk-free.

One concern, raised by some campaigners, is moral hazard: if carbon-negative power plants make cattle farming more profitable, they could entrench high-emissions diets and delay shifts to plant-based proteins. Another is equity: the farms best placed to adopt sophisticated biogas and carbon-capture systems are often larger operations in richer countries, not the smallholders most exposed to climate shocks.

There is also a more technical worry: permanence. To claim genuine removal, projects must show that the CO₂ they inject will stay underground for centuries, not leak back out through poorly sealed wells. That calls for robust monitoring, reporting and verification – and clear rules about who is liable if something goes wrong.

Finally, carbon-negative power plants do not remove the need for more basic interventions. Feed additives that cut enteric methane, better manure storage, shifts in fertiliser use and changes in land-use policy will all be needed alongside any technological fixes.

If policymakers treat biogas-with-capture as a silver bullet, they risk repeating the mistakes made with first-generation biofuels and early carbon-offset schemes.

What to watch next

Reverion’s contract with Frontier will not transform global cattle farming on its own. But it does offer a useful early signal of where the intersection between agriculture, energy and carbon removal might be heading.

Over the next decade, three indicators will show whether the idea is taking root:

- Deployment beyond Germany. Do similar projects appear in other biogas-rich regions – from northern Italy to India’s sugar belt and Brazil’s dairy heartlands – or does the model remain confined to a handful of European demonstration sites?

- Cost curves. Do the costs of farm-scale BECCS fall towards the sub-$100-per-tonne range that Frontier and others see as necessary for mass deployment, or do they remain stuck in the high-hundreds, limiting the technology to boutique buyers?

- Integration into methane policy. As governments move from voluntary pledges to binding methane targets, do they recognise carbon-negative power plants as a core part of the strategy, or do they prioritise dietary change and on-farm management instead?

If the answers trend in the right direction, the anonymous grey containers on dairy farms may become a familiar feature of the landscape – part generator, part waste-treatment plant, part climate-repair machine.

For now, they are an experiment: a test of whether the world can turn one of its oldest emissions problems, the humble manure pile, into a source of both megawatts and negative emissions.