The search giant’s 50,000-tonne deal with Vaulted Deep looks modest on paper. The overlooked story is the attempt to set rules for measuring methane avoided from waste — a super-pollutant with outsized near-term warming power — and what that could mean for corporate climate ledgers, data-centre Scope 3s and the carbon removal market.

When Google announced this week that it would purchase 50,000 tonnes of carbon dioxide removal (CDR) from Vaulted Deep by 2030, most headlines clocked the size of the buy and moved on. They shouldn’t have. Buried in the fine print is a bigger swing: Google, Vaulted Deep and the Isometric registry will work together to quantify the methane emissions their approach prevents — an attempt to bring scientific rigor to a problem carbon markets and regulators have struggled to measure consistently.

Table of Contents

ToggleWhat’s actually new

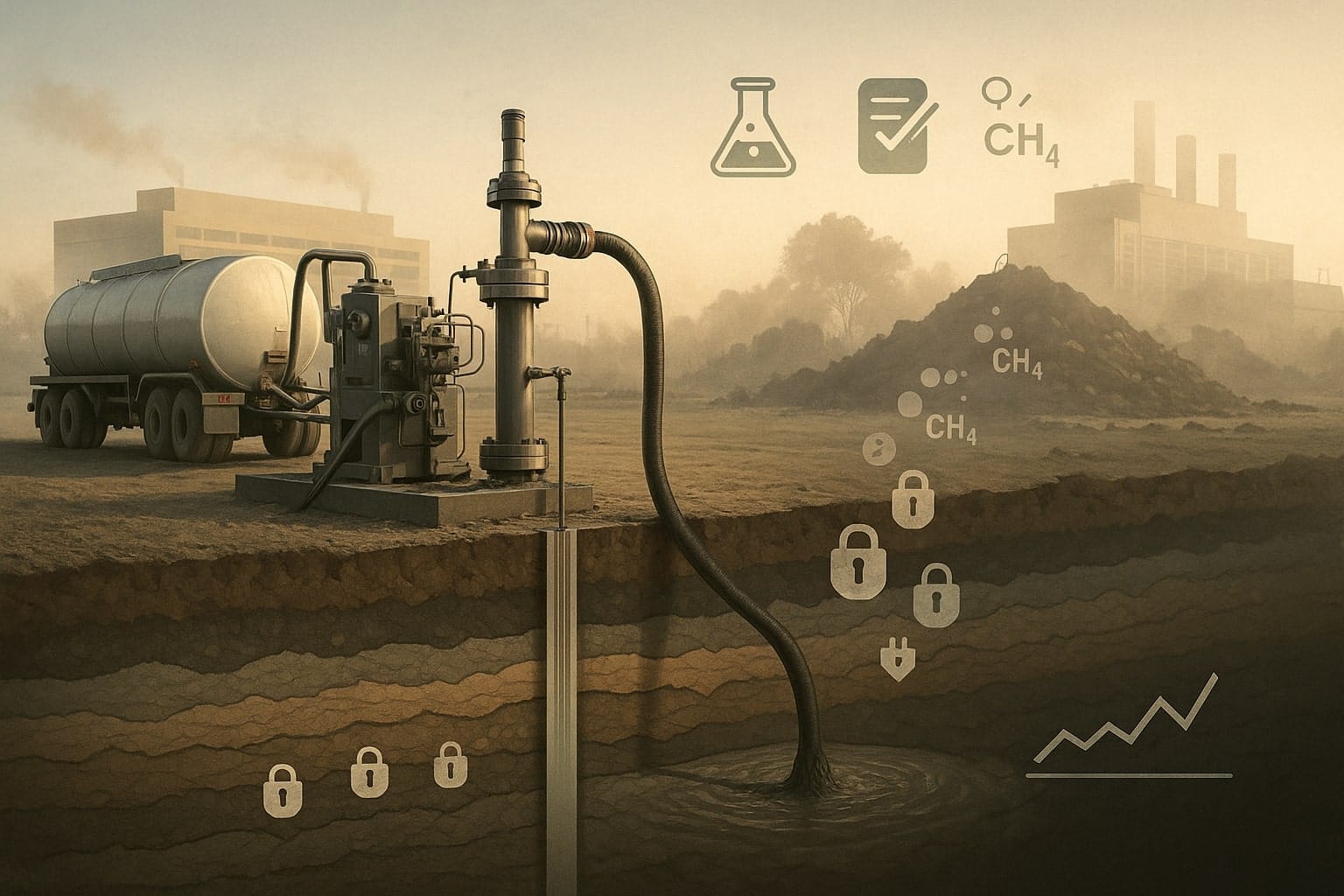

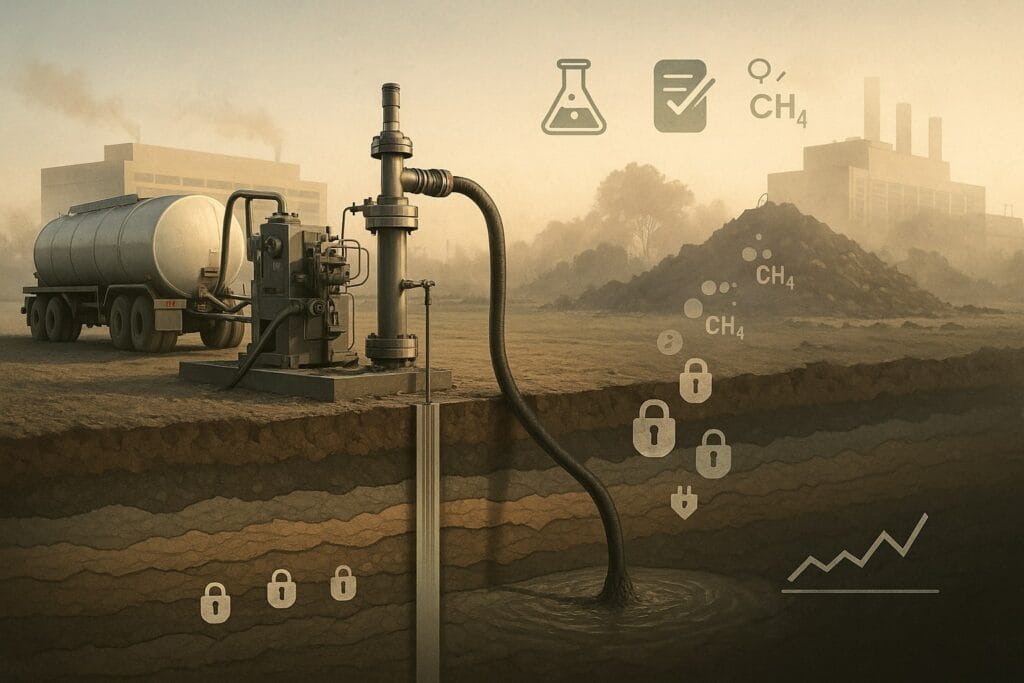

Two things matter here. First, the removals themselves: Vaulted Deep takes organic wastes (think food scraps, paper sludge, manure, biosolids) and injects them deep underground, effectively turning “waste-to-rock” over geologic timescales. Google’s offtake — certified under Isometric’s durable CDR framework — is slated for delivery by 2030, with initial projects in Hutchinson, Kansas. Second, and more consequential, the partners say they’ll publish a scientific framework for methane accounting tied to this waste injection pathway.

Why care about methane? Because over a 20-year period it traps more than 80 times as much heat as CO₂. Cutting methane is the fastest lever we have to slow warming this decade — which is why defining how to measure it, credibly and comparably, matters.

A standards gap hiding in plain sight

Plenty of methodologies exist to credit captured landfill methane — protocols that pay when a landfill installs a gas collection system and flares or uses the gas. Those frameworks, however, were built for projects where methane is already forming and being captured. They don’t neatly cover a pathway where organic waste never decomposes at the surface in the first place because it’s injected and permanently immobilized underground. The baseline, counterfactual and leakage questions are different.

That distinction isn’t academic. Even among conventional landfill-gas credits, recent independent analyses have flagged over-crediting risks and additionality gaps — a reminder that sloppy baselines erode trust. Any new methane-MRV template that aspires to CFO-grade acceptance will need to show its work.

The Vaulted method, in brief

Vaulted Deep’s “bioslurry injection” repurposes long-used oil-and-gas disposal technology to push a carbon-rich slurry of organic wastes nearly a mile underground into sealed formations overseen under EPA’s Underground Injection Control (UIC) program. This isn’t point-source CO₂ capture; it’s waste management that results in durable carbon storage and, potentially, prevents methane formation entirely. Isometric’s standard requires ≥1,000-year durability by default — a high bar intended to separate removals from short-lived avoidance credits.

The methane puzzle the partnership is trying to solve

Measuring carbon in waste is relatively straightforward; measuring methane that doesn’t form is hard. Methane generation varies by feedstock, temperature, moisture, handling practices and microbial conditions. Today there is no widely recognized, cross-pathway standard for quantifying methane prevention in waste management — hence Google, Vaulted and Isometric’s plan to convene scientists, agree criteria, and publish a methodology and report. If they succeed, they won’t just validate one project; they’ll create a template others can adopt (or attack).

Why Google cares (and why others will, too)

Google’s own environmental reporting shows the company tightening operational emissions even as AI drives energy demand higher, with most of the footprint still concentrated in Scope 3. The firm has also diversified its CDR portfolio: enhanced rock weathering (Terradot), biochar (Varaha/India), reforestation removals (Mombak/Brazil), and now waste-to-rock — a mix that spreads technology risk and delivery timing. The methane-MRV strand complements earlier “super-pollutant” moves on fluorinated gases and landfill methane.

What’s different this time is the attempt to standardise methane accounting rather than simply buy avoidance credits from existing landfill-gas projects. If a rigorous MRV emerges, you can imagine corporate ledgers that track two columns with equal discipline: (1) Durable removals (≥1,000-year) to neutralize residual emissions in 2030-style targets, and (2) Verified super-pollutant reductions with clear time-horizons (e.g., 20-year GWP) to curb near-term warming. That dual-metric view is much closer to climate physics than a single “tCO₂e” number.

The waste-sector wedge is non-trivial

By EPA accounting, landfills alone contributed about 14.4% of U.S. human-related methane in 2022; wastewater adds a quarter of the waste-sector pot. Add manure management (usually counted under agriculture) and you are approaching the “~40% of U.S. methane” figure often cited when waste and agriculture’s waste streams are combined — precisely the messy boundary that consistent MRV must navigate. Meanwhile, aerial and satellite work keeps finding persistent landfill super-emitters, suggesting that official inventories may undercount without more granular measurement.

The small print that matters for markets

- Durability & integrity: Isometric’s standard defaults to ≥1,000-year storage for removals, with transparent project-level data. If methane-MRV is co-published to a similar bar, it could help investors, auditors and buyers trust “super-pollutant” claims the way they’re starting to trust high-durability removals.

- No “methane avoidance” credit stacking (yet): Vaulted says the work is about understanding true climate impact, not minting avoidance credits on top of removals. That choice sidesteps double-counting for now — and keeps the focus on science over monetization — but the temptation to financialise avoided methane will come if a method is accepted.

- Comparability with existing LFG credits: Established landfill-gas protocols (CAR, VCS/CDM) reward capture and destruction. A prevention-MRV pathway needs clear baselines so it’s not just a different wrapper for the same tonne. Expect debates over system boundaries and leakage.

- Procurement archetype: Portfolio buys are becoming the norm for blue-chip buyers (Google, Microsoft, Schneider Electric, others), spreading delivery risk across DAC, BECCS, ERW, biochar, and now waste-to-rock. Microsoft’s 12-year offtake for up to 4.9 million tonnes with Vaulted underscores how fast this corner is scaling.

Risks and open questions

Baselines and counterfactuals. How confident can we be that a given tonne of organic waste would have produced methane under typical handling, and at what rate? Regional waste practices differ; so do local ozone-and-crop co-benefits. The method will need conservative assumptions and uncertainty accounting to avoid the over-crediting seen in some landfill-gas projects.

Interaction with regulation. As EPA ratchets methane rules across sectors, MRV must ensure project-level claims aren’t simply codifying what regulation would have forced anyway (i.e., additionality). Existing protocols address this via “practice-change” tests; a prevention-MRV will need an equivalent.

Data sources. Expect a triangulation of lab data (biogas potential), field measurements, facility operating data, and remote sensing. The bar will be whether leakage-free evidence chains are auditable to the level of an Isometric issuance — and whether independent scientists agree.

Why this could set a precedent

If Google and partners can publish a defensible, transparent way to measure methane prevention from waste injection — and it stands up to peer review — the result would be more than a single supplier win. It would be a new category of super-pollutant accounting that others (from food waste handlers to wastewater authorities) could plug into. In markets still grappling with quality, the combination of durable CO₂ storage and high-confidence methane MRV could become the de-facto blueprint for companies balancing long-lived removals with near-term warming cuts.

Bottom line

The tonnage in Google’s latest purchase won’t move its footprint by itself. The rules it could help write might. If the partners deliver a credible, public method for methane-prevention MRV — and if registries and auditors adopt it — the market will have a sturdier way to price what the atmosphere feels most in the next 20 years. That’s a bigger deal than a single 50,000-tonne contract.