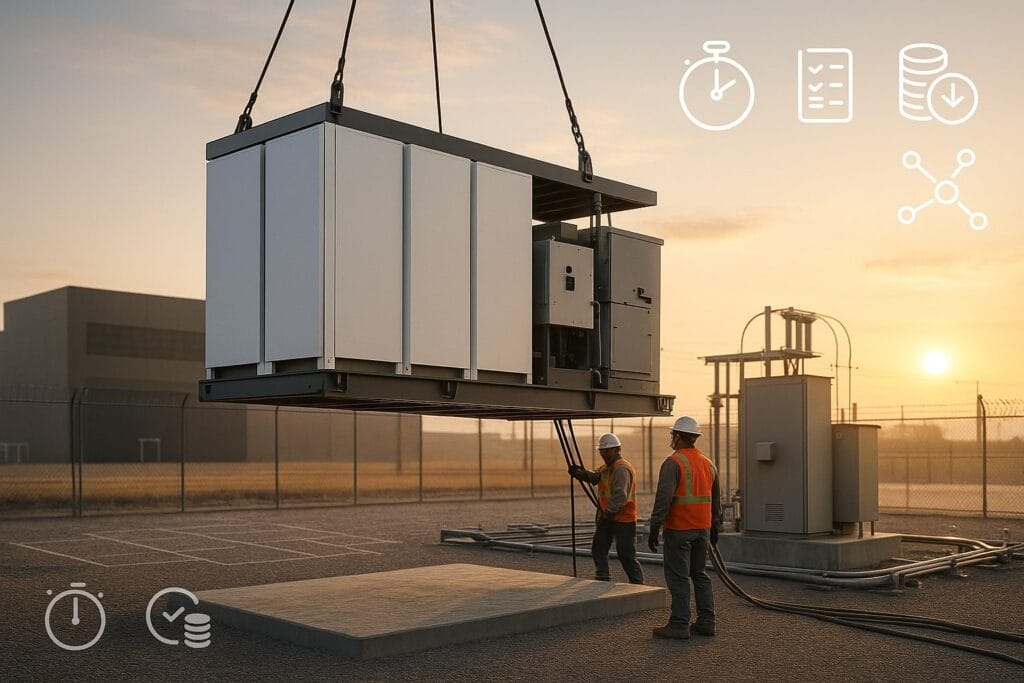

Tesla has packaged four Megapack 3 units, a transformer and switchgear into a factory-built “Megablock.” The promise: faster interconnects, denser sites and materially lower on-site construction. If it works, grid batteries start to look less like bespoke projects and more like plug-and-play infrastructure.

Table of Contents

ToggleThe news, stripped to essentials

At RE+ in Las Vegas, Tesla unveiled Megablock, a pre-engineered 20 MWh building block that combines four Megapack 3 units with a site transformer and switchgear. Tesla says the configuration enables 23% faster installation with up to 40% lower construction costs versus today’s practice of wiring packs to field-installed balance-of-plant. Megapack 3 itself brings a 78% reduction in thermal-bay connections and a redesigned heat-pump system to cut failure points. Initial Megapack 3 manufacturing is slated for Houston, with shipments of Megablock targeted for 2H 2026.

Why this matters: the soft-cost center of gravity

Grid batteries are no longer novel; their bottlenecks are. In the U.S., storage made up roughly a quarter of planned new capacity in 2024 and is on track for another record year in 2025, with ~18–20 GW expected to be added. But projects are slowed—and budgets strained—by site work, interconnection and bespoke engineering.

Those “soft” and balance-of-system line items are not trivial. NREL’s 2025 bottom-up model pegs a 4-hour utility-scale Li-ion system at ~$334/kWh (2024$), a figure that explicitly includes non-cell costs such as electrical and structural BOS, installation labor, permitting/interconnection, EPC overhead, contingency, taxes and margin. Pushing assembly into the factory—especially medium-voltage terminations—attacks the part of the bill most exposed to schedule risk.

What’s actually different here

- From packs to blocks. A Megablock arrives with four Megapack 3 units already tied into a transformer and switchgear; Tesla also touts a site-level density of 248 MWh per acre, leaving required service clearances intact. For developers fighting land constraints near substations, that density is the headline. (For context, an earlier Megapack project in Oxnard, California packed ~200 MWh/acre.)

- Fewer field connections. Tesla’s energy chief Mike Snyder says conventional layouts can mean up to 24 medium-voltage connections per pack; Megablock’s architecture cuts that to three. Fewer bolted connections means less on-site labor, fewer QA points and fewer call-outs later.

- Speed as a product metric. Tesla is marketing the ability to commission 1 GWh in 20 business days using Megablock—an audacious claim that will need to be proven on real interconnects.

The queue problem Megablock is really aimed at

The U.S. interconnection backlog has swollen to ~2.6 TW of proposed generation and storage, and typical projects have stretched toward five years from request to operation. New FERC rules and digital tooling may compress timelines, but any reduction in field-scope complexity helps developers survive the gantlet. Modular AC blocks that minimize site wiring and standardize layouts don’t fix the queue—but they reduce the number of things that can go wrong while you’re in it.

How the economics could move

Tesla is not claiming a 40% cut to total capex—only to construction costs. Still, if you accept NREL’s framing that a significant share of a battery project’s total is everything except cells and inverters, then a 40% reduction to the construction slice can translate to a meaningful—if project-specific—single-digit to low-teens percent reduction in total installed cost. The bigger prize may be schedule: months saved on site can be worth more than dollars saved on steel when merchant revenues and liquidated damages are at stake.

There’s also the land math. At 248 MWh/acre, a 1 GWh site pencils to roughly four acres of battery field (before laydown, access, stormwater), which is materially tighter than many current layouts. Denser sites can mean cheaper interconnects (shorter trench runs) and more “yes” parcels near substations—often the scarcest input.

Supply chain and timing

Tesla says Megapack 3 will be built near Houston with ~50 GWh/year capacity when ramped, complemented by its Shanghai Megafactory and cell supply from partners such as BYD and CATL. The company guides first Megablock shipments for late 2026. Those are ambitious timelines; the competitive field is not standing still.

The competitive lens: integration vs. containers

Rivals already sell integrated platforms—Fluence Gridstack Pro and Wärtsilä GridSolv Quantum standardize enclosures, controls and layouts to cut field work. Meanwhile CATL’s TENER pushes cell-level density to 6.25 MWh in a 20-foot container, even touting “zero degradation” over five years. But Tesla’s marketing centers on site-level density and factory-assembled AC blocks that ship with transformers—an apples-to-oranges distinction that matters for permitting and crews. Expect incumbents to lean harder into AC-block architectures and factory wiring in response.

The data-center undertow

Why now? U.S. electricity demand is setting fresh records, with data centers a primary culprit; markets like PJM are explicitly planning for tens of gigawatts of incremental load and capacity prices have spiked. In that context, a battery block that promises speed, density and lower site risk is as much a time-to-market story as a cost story.

What to watch (and what could go wrong)

- Field proof. Can Megablock actually hit the 20-day/GWh claim on real-world projects with utility inspections, weather and change orders? Early deployments will be scrutinized for commissioning speed and punch-list length.

- Interconnection realities. Queue reforms are underway, but processing times and upgrade costs remain volatile by region; Megablock doesn’t change that physics.

- Thermal & serviceability. The 78% reduction in thermal connections is promising; operators will watch failure rates and mean time to repair on the new heat-pump architecture.

- Supply chain & price discipline. A Houston ramp and Chinese capacity help, but cell sourcing (BYD/CATL) and tariff policy will influence delivered costs in 2026–27.

- Software edge. Tesla’s trading/controls stack has been a differentiator; utilities will benchmark gross margins and availability against Fluence/Wärtsilä in markets like CAISO, ERCOT and NEM. (Evidence from CAISO shows batteries are already material to system operations.)

Bottom line

The leap here isn’t chemistry. It’s industrialization: take wiring and medium-voltage work off the pad, ship denser AC blocks, and treat sites like racks in a data hall. Given the scale of the interconnection backlog and the premium on speed, that’s exactly where grid-scale storage needs to evolve. If Tesla’s Megablock performs as advertised, expect 2026–27 to mark the moment utility batteries began to look—and get built—like true infrastructure rather than one-off construction projects.