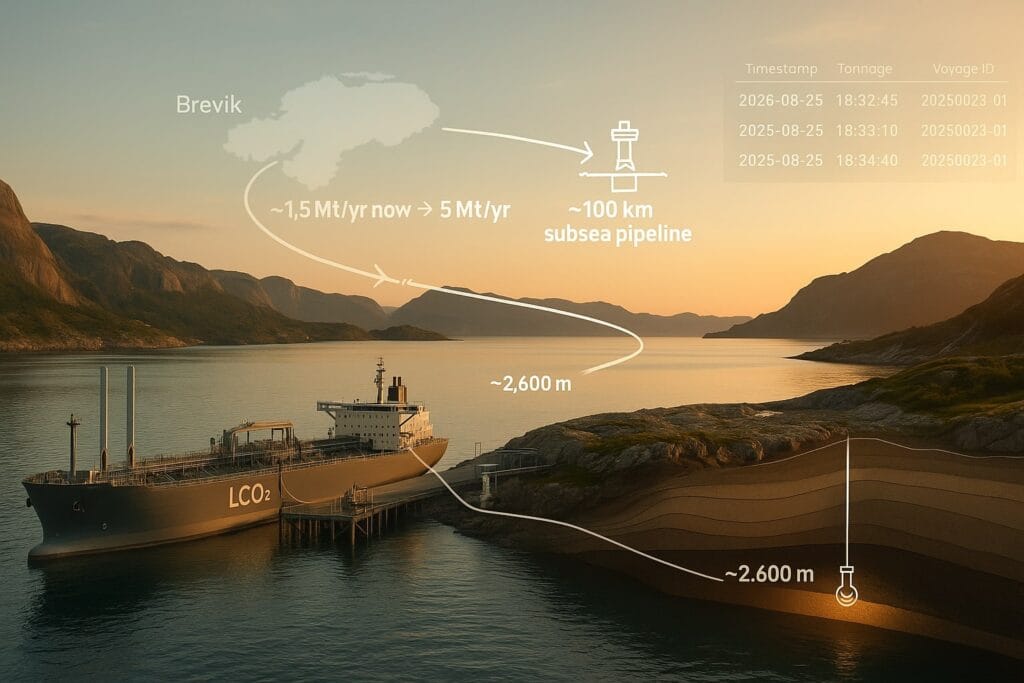

By any measure, it’s a milestone: Norway’s Northern Lights project has begun injecting CO₂ 2,600 meters beneath the North Sea, receiving its first shipment from Heidelberg Materials’ Brevik cement plant and pushing the start button on Europe’s first open-access, cross-border carbon capture and storage (CCS) value chain. The owners — Equinor, Shell and TotalEnergies — confirmed first injection on August 25, 2025, marking the operational start of Phase 1 (1.5 Mt/yr; ~37.5 Mt over 25 years) — already fully subscribed — and the green-lighted expansion to ≥5 Mt/yr under Phase 2.

Table of Contents

ToggleWhat just happened — and why it matters

For the first time, an industrial emitter in one country is capturing CO₂, loading it onto a dedicated LCO₂ ship, offloading it at Norway’s Øygarden terminal, and piping it offshore for permanent geological storage — a complete capture-to-storage chain that crosses borders and uses shipping rather than pipelines to solve the “last mile”. It’s a deliberate proof-of-concept for hard-to-abate sectors: cement, waste-to-energy, chemicals and fertilisers that are not neatly connected to storage by pipe.

- The first cargo came from Brevik CCS, the world’s first full-scale cement capture unit (design capacity ~400,000 t/yr, inaugurated June 2025). The CO₂ was delivered to Øygarden, then sent via a ~100 km pipeline to the injection site.

- Phase 1 capacity (1.5 Mt/yr) is fully booked; Phase 2 (FID March 27, 2025) adds ≥3.5 Mt/yr backed by a 900,000 t/yr, 15-year biogenic CO₂ contract with Stockholm Exergi.

For business readers, the significance isn’t only technical. Northern Lights is the first merchant “storage-as-a-service” network in operation: it sells capacity to multiple emitters across jurisdictions on commercial terms, rather than as a single-site, single-offtaker scheme. That architecture is the scalable bit.

The new template: capture → ship → store (and who does what)

- Capture at source (Brevik cement; later Oslo’s Hafslund Celsio waste-to-energy) using amine-based systems; captured CO₂ is dehydrated and liquefied on site.

- Transport by LCO₂ carriers — the Northern Pioneer and sister vessels (7,500 m³ class, LNG-fuelled with rotor sails and air lubrication) — built by Dalian Shipbuilding and entering service 2024–25.

- Reception and storage at Øygarden, then injection via an offshore well into a deep saline formation ~100 km off Norway. Offshore Magazine

Because cargoes originate outside Norway and are stored offshore, this chain leans on the London Protocol’s 2019 provisional application of its 2009 amendment, which permits cross-border export of CO₂ for sub-seabed storage among consenting parties. Without that legal tweak, Northern Lights’ shipping model would be impossible.

Does shipping CO₂ still cut emissions? The math

Lifecycle analysis commissioned by the JV estimates ~0.026 tCO₂e emitted per tonne stored across the entire chain (construction → operation → post-closure) at Phases 1–2 scale, implying ~97% net abatement. Shipping accounts for roughly 91% of the chain’s own footprint — which is why the carriers use LNG, rotor sails and air lubrication, and why further options (bio-LNG, on-board capture) are being evaluated for Phase 2. Put plainly: even after counting vessel fuel and all infrastructure emissions, over 97 tonnes are stored for every 100 tonnes sent to Northern Lights.

Who carries the risk — and the liability?

Two regimes matter: maritime and geologic.

- Maritime: Cargoes move under standard shipping contracts, with emissions and monitoring subject to EU MRV and, from 2024, EU ETS for maritime (phased coverage of voyages/berth emissions). As CO₂ carriers serve EU/EEA ports, their fuel use and port calls are reportable and increasingly costed, tightening the carbon ledger.

- Geologic: In Europe, the CCS Directive (2009/31/EC) sets long-term monitoring and transfer of responsibility to the state once stability criteria are met (typically ~20 years after closure, sooner if conformance is proven). Norway’s guidance allows earlier transfer once those criteria are satisfied. Practically, the operator holds operational liability; long-term stewardship passes to the state.

- Chain gaps: Negotiations for Longship clarified that leakage risk during shipping would not sit with Heidelberg Materials; Northern Lights and the state cover those costs — a useful precedent for future cross-border contracts of affreightment.

The economics (so far): public ballast, private sails

Longship — the umbrella covering Brevik CCS, Hafslund Celsio and Northern Lights — is heavily state-backed. Norway originally estimated NOK 25.1bn for capex + 10-year opex, with roughly two-thirds public funding; more recent updates peg total allocations near NOK 30bn as the project completed major works in 2024–25. That public ballast is doing what it says on the tin: de-risking first-of-a-kind infrastructure and anchoring a merchant market with multi-year, take-or-pay contracts.

For U.S. readers, the natural comparison is 45Q. The Inflation Reduction Act set $85/t for point-source CO₂ stored in saline formations and $180/t for DAC — headline numbers that have catalysed megaprojects stateside, even as trade groups warn that the real value erodes without earlier indexation and with construction/interest cost spikes. In Europe, the value stack mixes ETS-avoided emissions, national support, and EU instruments (e.g., Innovation Fund, NZIA storage obligations). Different mechanisms, same intent: close the viability gap to get concrete, steel and waste-to-energy into the game.

The market signal: from one-off demos to a storage market

Three datapoints suggest Northern Lights is more than a showpiece:

- Phase 1 is sold out, with a queue of third-party demand; Phase 2 FID arrived only after locking in an anchor 900 kt/yr of biogenic CO₂ from Stockholm Exergi. That’s merchant discipline, not demonstration logic.

- The JV and Norway have built the first dedicated LCO₂ fleet (four 7,500 m³ ships and follow-on tonnage), creating a portable transport asset class that can serve multiple capture points — pivotal when emitters are dispersed.

- Brussels is now forcing the storage market into existence: the Net-Zero Industry Act sets an EU-wide 50 Mt/yr injection capacity target by 2030, and the Commission has asked 44 oil & gas firms to contribute proportionally. That creates real supply to match rising capture announcements.

Zooming out, the IEA counts ~50–57 Mt/yr of operational capture/storage globally today and ~430 Mt/yr of announced capture by 2030. Announcements still outrun delivery — but this is the first day you can point to a cross-border, ship-to-storage system that’s actually moving molecules.

What changes for cement — and for buyers of “net-zero” materials

Cement is the canonical CCS use-case because process emissions dominate (calcination), meaning even 100% renewable power leaves ~60% of the plant’s footprint intact. Brevik’s evoZero product is already sold out for 2025, despite a price premium — evidence that buyers with Scope 3 pressures (infrastructure owners, developers) will pay for verified storage if certificates are bankable. The Northern Lights chain provides exactly that: custody transfer, MRV, and ISO-aligned storage accounting.

The MRV plumbing matters. Between EU/UK MRV for shipping emissions, EU ETS application to maritime, and storage monitoring under the CCS Directive, the paperwork for each tonne — from loading arm to post-closure seismic — is becoming auditable. That, in turn, is what lets financial markets (and public procurement) treat captured-and-stored as a commodity claim, not a press release.

The U.S. angle: replication, complement — not competition

For U.S. developers staring at interstate CO₂ pipelines, Northern Lights offers an alternative routing logic: ship where pipes won’t.

- Geography: The Gulf Coast concentrates emitters and storage — ideal for hubs. But along the Atlantic and Pacific coasts, shipping could link scattered emitters to offshore storage if/when federal and state rules mature. DOE has even studied CO₂ shipping feasibility in U.S.–allied contexts.

- Timing risk: Shipping is modular and redeployable; it can right-size early volumes and de-risk demand forecasts. The Northern Lights fleet underscores that tonnage can be built and moved before long pipelines are permitted.

- Policy fit: 45Q is generous on storage value but neutral on how molecules move; Class VI permitting and pore-space access remain gating items. Europe, by contrast, is mandating storage supply and standardising cross-border trade. Different levers, same goal — but the shipping template is now de-risked.

Friction points to watch

- Cost to customers. Delivered-and-stored costs for early cement/energy-from-waste cargoes will be closely studied by U.S. and EU procurement. Expect debate over who pays for the ship leg as volumes scale. (Norway’s cost-share — roughly two-thirds public funding — won’t be replicable everywhere.)

- Insurance & contracts. The leakage-in-transit clause struck for Brevik — where the state/JV assumed that risk — is a precedent, but not a global standard. As volumes cross more borders, expect bespoke policies and MRV-linked warranties for each hand-off.

- Maritime carbon costs. As EU ETS coverage for shipping ramps to 100% (from 2027 on reported emissions), LCO₂ carriers will have a visible carbon line item — a mild headwind that also strengthens the integrity of the value chain.

- Permitting & public licence. Cross-border flows rely on the London Protocol’s provisional application until the amendment fully enters into force. Politics — not engineering — could become the binding constraint if more parties are needed to enable wider cargo routes.

Bottom line

Northern Lights turns a decade of policy and engineering into a working market for third-party CO₂ storage. It’s modular (ships), auditable (MRV, ISO, ETS) and bankable enough to win multi-year offtakes — all while demonstrating that net climate benefit survives real-world logistics (~97% abatement, lifecycle). If you’re an industrial emitter, a materials buyer, or an infra investor, this is the moment the cross-border CCS story stops being hypothetical. The molecules are moving.