On paper, 5 gigawatt-hours is just a number. In practice, it is a signal flare.

On Tuesday, February 3, 2026 (Pacific Time), South Korea’s LG Energy Solution said it had signed a contract to supply 5GWh of lithium iron phosphate (LFP) battery cells to Hanwha Qcells USA for utility-scale energy storage projects in the US between 2028 and 2030. The cells will be made at LG’s plant in Holland, Michigan.

The deal is not about a single “mega-project”. It is about a supply line — and the politics now attached to it.

If you want to understand where the American energy transition is heading, do not start with a solar farm in the desert. Start with a factory in the Midwest. Because in today’s US grid, the battery has become more than hardware. It is a hedge against trade risk, a bid for tax credits, and a response to a grid that increasingly needs power to arrive on demand — not only when the wind blows or the sun shines.

Table of Contents

ToggleThe new scarce resource is not sun or wind — it is “firm” electrons

Battery storage is having its “big infrastructure” moment. The US Energy Information Administration has projected a record wave of battery storage additions, and it has already been rising at a pace that would have seemed fanciful a few years ago.

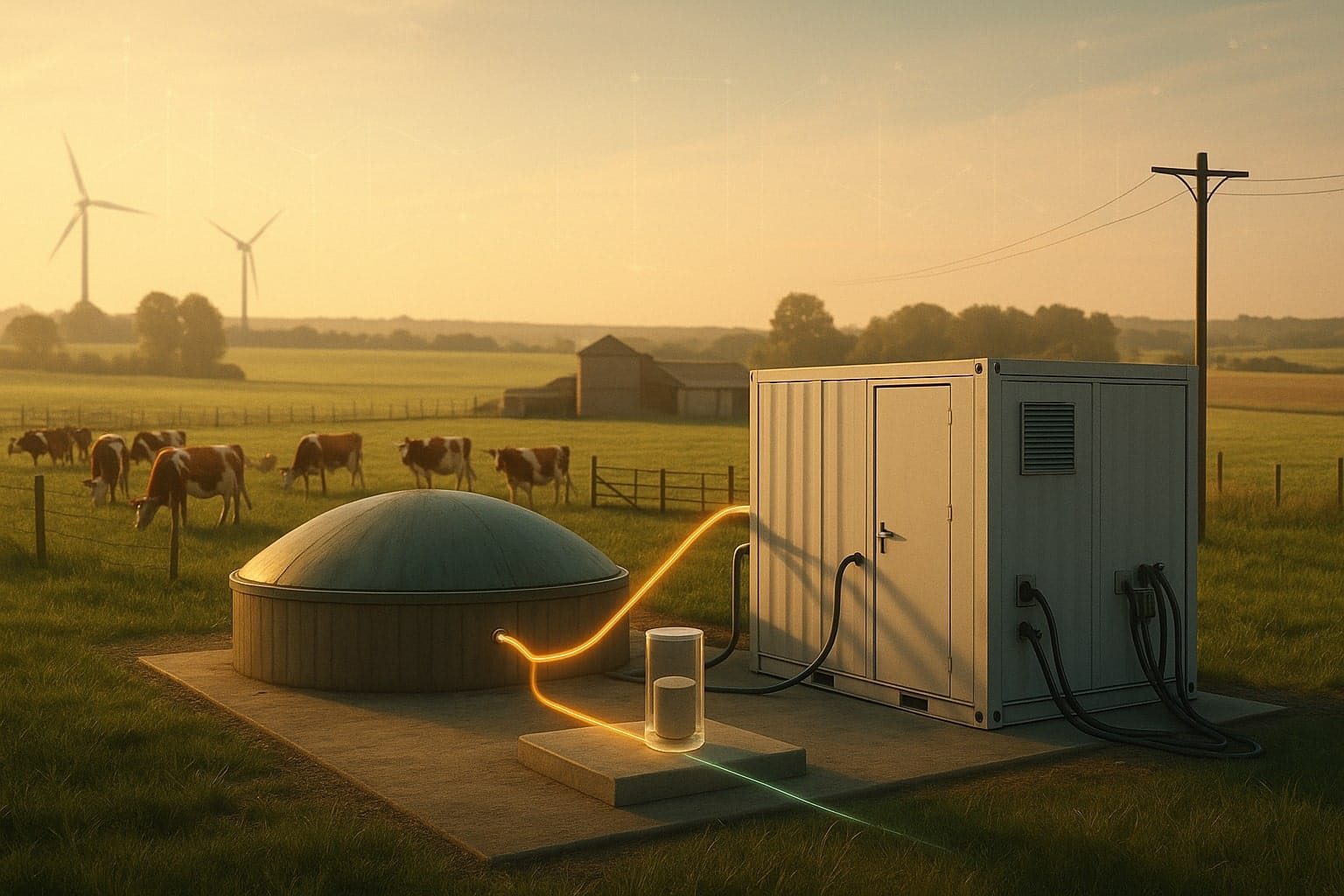

This boom has a simple driver: grids built around big thermal power plants are being asked to behave differently. More electricity is arriving in clumps — midday solar being the obvious example — while evening demand remains stubborn. Batteries smooth that mismatch. In the best cases, they can also reduce the need for costly “peaker” power plants and offer services that keep frequency stable and networks resilient.

In other words, batteries are turning renewable electricity into something closer to a conventional product: power that shows up when it is needed.

That shift has consequences for supply chains. When storage was a niche add-on, buyers could treat battery procurement like a normal component decision. As storage becomes central, supply turns strategic — and this is where domestic manufacturing enters the story.

Why this contract matters more than its size suggests

Five gigawatt-hours of energy storage is meaningful, but the number itself is not the point. (To translate: 5GWh is 5,000 megawatt-hours. Spread across four-hour battery systems, it equates to roughly 1.25GW of power capacity; spread across two-hour systems, roughly 2.5GW.)

The deeper point is what the contract is trying to buy: certainty.

Energy storage developers face an awkward truth. Demand is rising, but the market’s rules are still shifting. Tariffs, trade restrictions, and eligibility rules for federal incentives can all change the economics of a project after the financial model is built. A battery that looks cheap on a spreadsheet can become expensive once you add uncertainty.

The Qcells–LG structure is designed to remove some of that uncertainty. Qcells says the projects will meet US domestic content requirements, pairing Michigan-made battery systems with solar panels that Qcells manufactures in Georgia. The message is clear: “made in America” is not only branding — it is a financing strategy.

This matters because for many utility-scale projects, the difference between “financeable” and “not financeable” is often not technology. It is whether investors believe the project will qualify for incentives and avoid sudden policy shocks.

LFP: cheaper, safer, and suddenly geopolitically sensitive

The chemistry choice also tells a story. LFP batteries have become the default option for many stationary storage projects because they are typically cheaper and can offer strong cycle life and thermal stability. For grid storage, energy density is less important than it is for cars. A battery does not need to be light; it needs to be reliable.

For years, China built a formidable lead in LFP manufacturing at scale, which helped push prices down globally. But dominance comes with a shadow: dependence.

As storage grows into a critical piece of infrastructure, relying heavily on imported cells — particularly from a geopolitically fraught supply chain — has become a political vulnerability. That is why American policymakers increasingly talk about “secure supply chains” with the same seriousness once reserved for semiconductors.

The result is a market that is being pulled in two directions at once. Buyers want the lowest cost, which often means tapping the deepest, most established manufacturing base. But they also want resilience, which increasingly means sourcing closer to home.

The LG–Qcells contract is a bet that the second desire is now strong enough to support long-term demand for US-made LFP — even if it carries some premium.

The hidden engine: tax credits that shape where factories get built

There is a second reason “domestic” has become a commercial word, not only a political one: federal incentives.

In the US, energy storage projects can qualify for investment tax credits, and projects that meet domestic content standards can receive a bonus. Meanwhile, manufacturers of eligible clean-energy components can qualify for the advanced manufacturing production credit, which — for battery cells — is calculated on capacity.

This creates a powerful dynamic: the battery is not only sold to a developer; it is also processed through an incentive system that rewards particular places and supply chains.

Put bluntly: a battery in America is no longer only a product. It is also paperwork — and sometimes the paperwork is worth almost as much as the product.

Consider the arithmetic. If a manufacturer receives a per-kilowatt-hour credit for making eligible battery cells, then capacity matters enormously. Five gigawatt-hours equals five million kilowatt-hours. Multiply that by a per-kWh production credit and you begin to see why manufacturers are fighting to localise production and why buyers want long-term contracts with those plants.

This is not a moral argument for or against subsidies. It is a practical observation about how markets behave when policy becomes part of pricing.

Michigan as a clue: the grid boom is changing the battery industry itself

The other quiet story inside this deal is what it says about the battery sector’s centre of gravity.

Battery companies originally built many US factories with electric vehicles in mind. But the EV market’s timing has been choppier than expected, and grid storage has surged. Some manufacturers are adjusting accordingly, repurposing lines and expanding output aimed at stationary storage.

LG’s Holland site is emblematic of that shift: it is becoming a supply hub not only for cars, but for the grid.

In parallel, developers are also changing how they buy. Utility-scale solar once relied on a fragmented ecosystem of panel makers, inverters, EPC firms and financiers. Now, solar-plus-storage is often packaged more like an integrated infrastructure product — a bundle of equipment, warranties, monitoring software and long-term service.

Qcells and LG talk not only about cells but about “lifecycle services”. That language matters. A battery is valuable only if it performs, safely, for years. As more storage comes online, operating performance is becoming as important as the initial price.

The uncomfortable question: can “domestic” scale fast enough?

The vision is compelling: US-made solar panels, US-made batteries, and a grid that is more reliable and less exposed to external shocks.

But scale is the test — and it is not guaranteed.

Battery manufacturing requires not only factories but materials: lithium, graphite, cathode and anode components, separators, electrolytes. A cell made in the US can still contain a global mix of upstream inputs. Domestic manufacturing is not the same as total supply-chain independence, and no serious planner should pretend otherwise.

There is also the problem of time. Projects for 2028–2030 sound distant, but in grid terms they are close. Permitting, interconnection queues, transformer availability, and local acceptance can all slow deployment. A contract can secure batteries, yet still fail to deliver electrons if the rest of the system jams.

Even so, this is exactly why the deal matters. It is a sign that buyers are no longer waiting for the market to sort itself out. They are trying to lock in supply years ahead — and, just as importantly, lock in a narrative that fits the incentives and the politics of the moment.

What to watch next

This contract should be read as an early chapter in a larger story: the industrialisation of the grid transition.

Three questions will determine whether it becomes a template:

- Price: Will US-made LFP become cost-competitive, or will buyers accept a “security premium” for domestic supply?

- Policy durability: Will incentive structures remain stable enough for long-term contracting to feel safe?

- Execution: Can the projects navigate the real-world bottlenecks — interconnection, permitting, and local safety concerns — that increasingly shape storage deployment?

For years, the energy transition was described as a race to build more renewables. It is becoming something else: a race to make the grid behave like a modern economy needs it to behave — resilient, flexible and dependable.

In that world, a battery contract is not a footnote. It is a signpost.